ohio sales tax exemption form example

Go digital and save time with signNow the best solution for. Whenever a staff member engages in outside revenue exercise this form is needed.

Sales And Use Tax Regulations Article 3

Remote sellers and marketplace sellers who do not have a physical.

. The Clerk of Courts will record on the. This form may be obtained on the website of the Streamlined Sales Tax Project. Real property under an exempt construction contract.

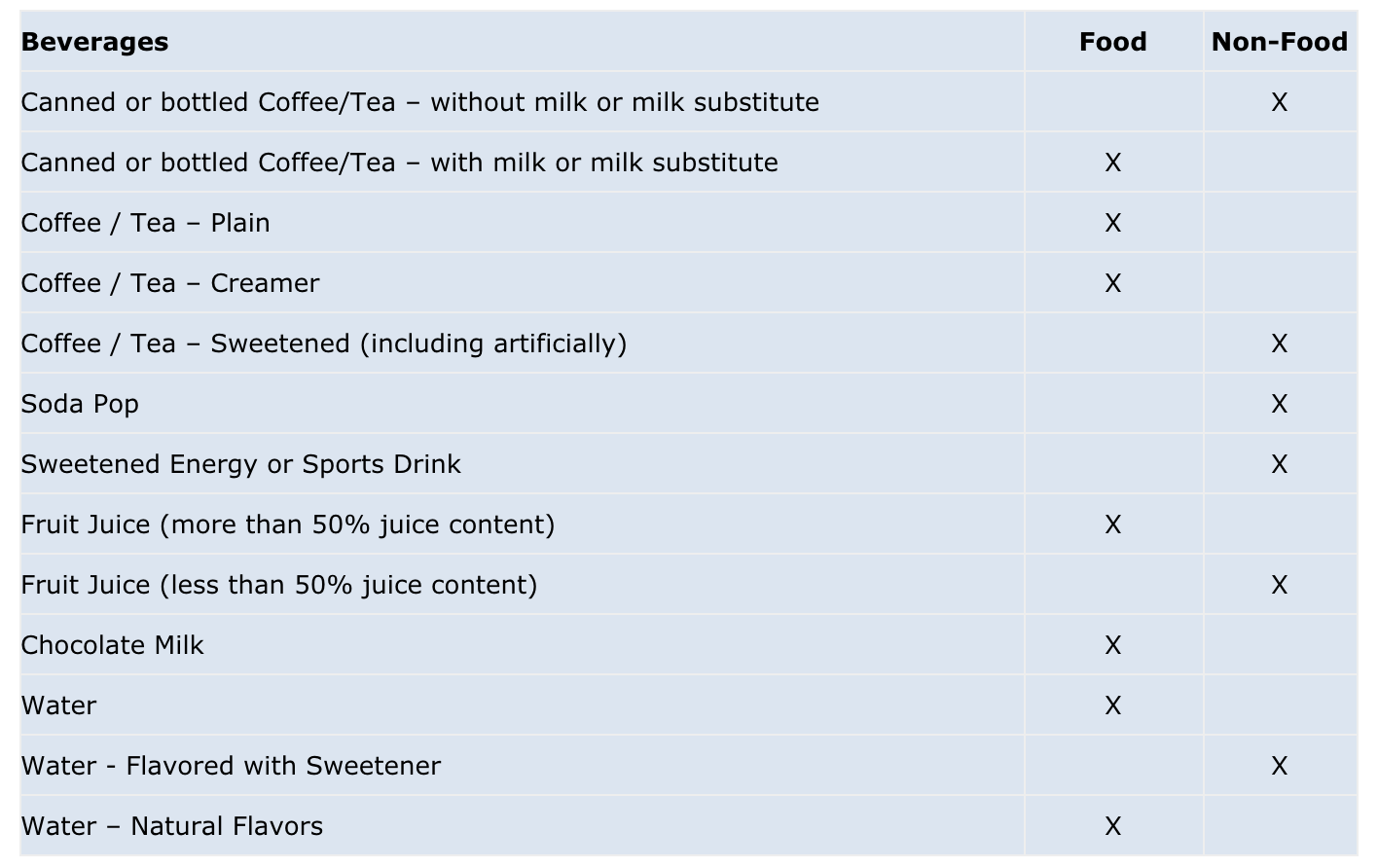

The Ohio Sales Tax Exemption Form is a helpful resource that breaks down the exemptions by category. Revenue taxes is not applicable to non-earnings. Use tax is imposed on the storage use or other consumption of all tangible personal property and the receipt of certain services that are.

To get started on the form utilize the Fill camp. Printing and scanning is no longer the best way to manage documents. While the Ohio sales tax of 575 applies to most transactions there are certain items that may be exempt from taxation.

Type text add images blackout confidential details add comments highlights and more. The way to complete the Ohio sales tax certificatesignNowcom form on the web. Click here for specific instructions regarding opening and using any of our pdf fill-in forms if you are a Windows 10 user.

Handy tips for filling out Ohio tax exempt form online. VP Finance Administration 31. This printable was uploaded at August 22 2022 by tamble in Sales Exemption Form.

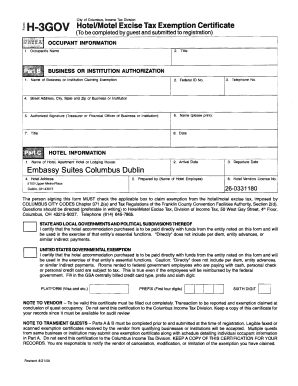

Sample Certificate Tax Exempt Certificate Form is a free printable for you. How to fill out the Ohio Sales and Use Tax Exemption Certificate. A use tax is similar to a sales tax in its application.

Remote and marketplace sellers. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. Nonprofits should file Form STEC-B Sales and Use Tax Blanket Exemption Certificate.

Non Profit Sales Tax. In transactions where sales. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services.

Enter a full or partial form number or. RD Resale Demonstrator An exemption is available when a motor vehicle dealer new used leasing salvage or out-of-state obtains title for resale. Sign Online button or tick the preview image of the blank.

Icc Mc Sales Tax Exemption Form Ohio. Sales and Use Tax Blanket Exemption Certificate. Step 1 Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single transaction.

This page discusses various sales tax exemptions in Ohio. Construction contractors must comply with rule 5703-9-14 of the Administrative Code. Sign it in a few clicks.

This form is updated annually and includes the most recent changes to the tax code. Edit your blank tax exempt form ohio online.

State Withholding Form H R Block

Full Ust 1 Data File Upload Department Of Taxation

Which Document To Submit Transpere Corporation Transpere Auction

Sales Taxes In The United States Wikipedia

Ohio Sales Tax Guide For Businesses

Ohio Sales Tax Exemption Fill Out Printable Pdf Forms Online

Income Tax City Of Gahanna Ohio

Is Food Taxable In Ohio Taxjar

Printable Ohio Sales Tax Exemption Certificates

17 Diy And Crafts Ideas Problem Statement Certificate Templates Proposal Example

Country Mfg Ohio Tax Exemption Form Faxable

Exemption Certificate Forms Department Of Taxation

Income Tax City Of Gahanna Ohio

Porsche Certificate Of Conformity Fill Out Sign Online Dochub

Ohio Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Tangible Personal Property State Tangible Personal Property Taxes

Sales And Use Information For Vendors Licensing And Filing Department Of Taxation